Related Articles

- Top 6 Niche Credit Cards from the Past Five Years That Exploit Unseen Reward Loopholes

- Unmasking the Silent Influence of Social Media Challenges on Long-Term Financial Behavior and Credit Recovery

- How Microcredit Dynamics in Remote Communities Are Redefining Access and Trust Beyond Traditional Credit Metrics

- How Cultural Attitudes Shape Collective Borrowing Habits and Their Impact on Financial Unification Strategies

- Top 5 Under-the-Radar Digital Loan Services Launched Since 2019 That Are Disrupting Traditional Borrowing Norms

- Top 6 Cutting-Edge Financial Wellness Platforms Redefining Debt Recovery Tools Released Since 2019

How Cultural Attitudes Shape Collective Borrowing Habits and Their Impact on Financial Unification Strategies

How Cultural Attitudes Shape Collective Borrowing Habits and Their Impact on Financial Unification Strategies

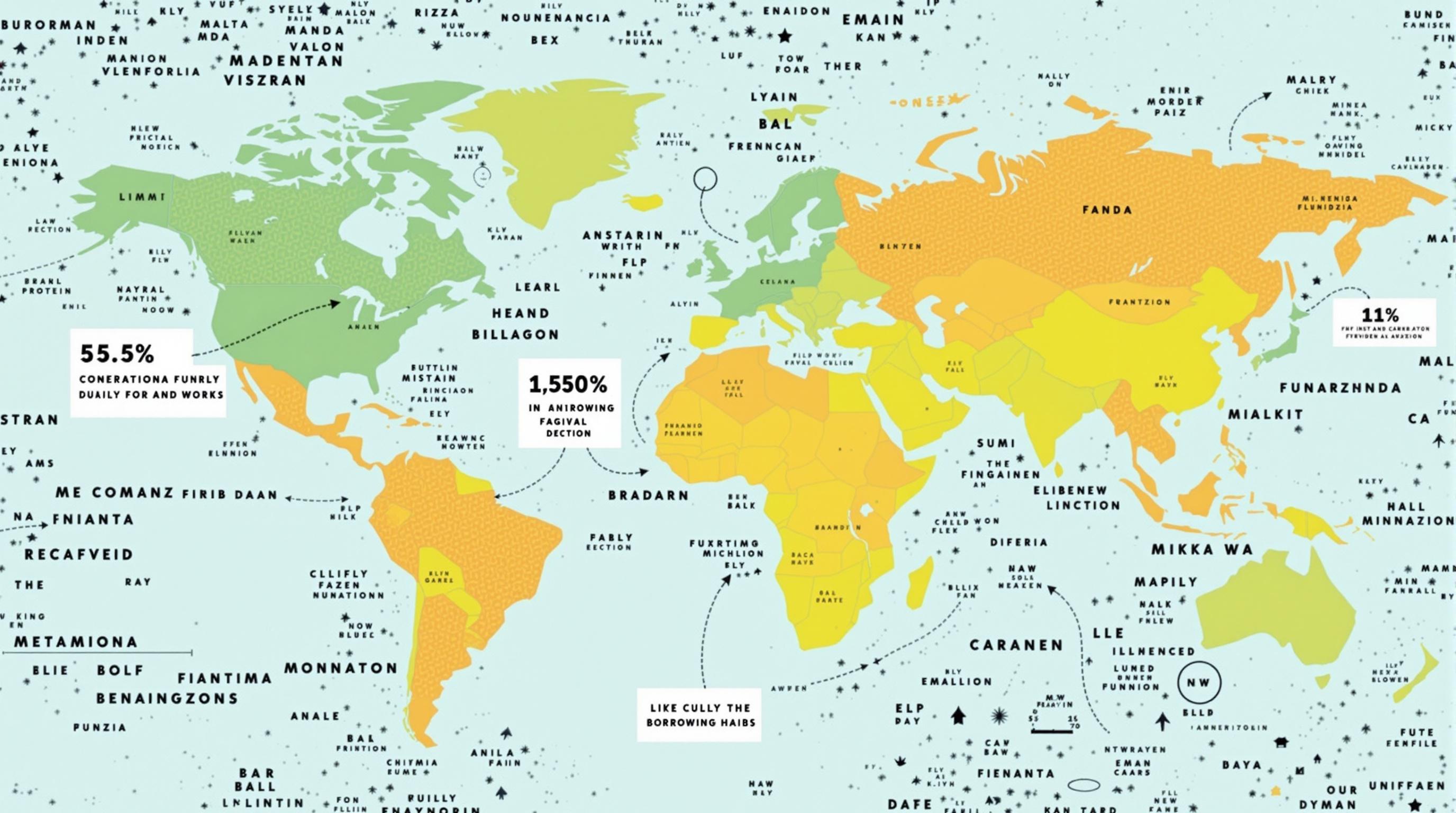

Collective borrowing habits are profoundly influenced by cultural attitudes, shaping not only personal financial behaviors but also national economic policies. Understanding these cultural dimensions is vital for crafting successful financial unification strategies in a globalized economy.

The Diversity of Borrowing Cultures Across the Globe

Not all borrowing is created equal—far from it. In Japan, for instance, borrowing is often viewed with caution and discretion. The cultural construct of “gaman” (endurance, patience) instills a preference for saving over debt, encouraging collective financial responsibility within families and companies. Contrast this with the United States, where borrowing, especially through credit cards and personal loans, has become woven into the fabric of everyday life, often seen as a tool for empowerment and consumption.

Financial Unification: A Challenge and an Opportunity

As nations push towards financial unification—whether through regional currency zones like the European Union or supranational economic partnerships—divergent borrowing cultures pose significant challenges. According to the International Monetary Fund (IMF), the European debt crisis of 2009 was exacerbated by different national attitudes towards debt and deficit spending, revealing cracks in the collective financial framework.

Humor Break: Why Did the Borrower Cross the Road?

To get to the “credit union” on the other side! But seriously, borrowing isn’t just about money, it’s about trust, social norms, and sometimes, downright fear of commitment.

The Role of Social Trust and Collective Liability

In many cultures, the concept of collective liability governs borrowing behaviors. For example, in parts of Africa and South Asia, microfinance models thrive on group lending, where the responsibility to repay is shared among community members. This trust-based system lowers default rates significantly. According to a study published by the World Bank, group loans have an average repayment rate of over 95%, outpacing many traditional lending schemes.

Storytime: The Village that Lends Together

Imagine a rural village where neighbors pool money to help one of their own start a business. Everyone’s creditworthiness is intertwined, pushing borrowers to act responsibly. This system isn’t just about economics; it’s a social contract that knits communities closer together.

Persuasive Argument: Why Cultural Awareness Matters in Global Finance

Ignoring cultural attitudes in financial planning is like trying to drive a car blindfolded. Financial institutions and policymakers must embrace cultural sensitivities surrounding borrowing to craft strategies that resonate locally and succeed globally. If financial unification efforts continue to treat all markets as homogenous entities, we risk repeating costly mistakes of the past.

Case Study: Eurozone's Divergent Debt Perceptions

The Eurozone offers a vivid illustration where Germany’s fiscally conservative culture clashes with more debt-tolerant economies like Greece and Italy. These differences complicate the European Central Bank’s efforts to harmonize monetary policy, ultimately affecting the bloc's financial stability and integration efforts.

The Casual Chat: What’s Your Relationship with Debt?

“I don’t like owing money, it feels like a leash,” says Sarah, a 29-year-old from Canada. This sentiment echoes in cultures that stigmatize personal debt and value financial independence. Meanwhile, others view borrowing as a strategic tool, essential for investments and economic mobility.

Statistics That Speak Volumes

Globally, household debt-to-income ratios vary dramatically: 130% in Australia, 66% in China, and 35% in India (OECD data, 2023). These figures are not just numbers; they reflect deep-seated cultural approaches to debt ranging from reliance to restraint.

Formal Insights: Economic Theories on Collective Borrowing

Economic scholars argue that cultural attitudes toward borrowing influence risk appetite and consumption patterns, which in turn affect macroeconomic cycles. This interplay suggests that for any financial unification to be sustainable, policymakers must integrate cultural psychology into economic models.

Example: The Informal Lending Market

In many Latin American countries, informal lending thrives alongside formal banking. This coexistence is a direct result of cultural perceptions of trust and accessibility. For instance, in Mexico, over 40% of loans come from informal sources, underscoring the necessity of understanding cultural contexts to unify financial systems effectively.

Generating Solutions: Toward Inclusive Financial Policies

Financial unification efforts must prioritize inclusivity by tailoring products and policies to different cultural backgrounds. Educational campaigns, culturally adapted credit scoring systems, and community-based lending initiatives can bridge gaps in understanding and acceptance.

Funny Yet True: Debt and Dating

Borrowing money can feel like dating — if timing, trust, and expectations don’t align, trouble brews. Just like in relationships, understanding cultural “deal breakers” in borrowing norms can save everyone from heartbreak.

Young vs. Old: Generational Attitudes Toward Debt

Age influences borrowing habits as well. Younger generations, particularly Millennials and Gen Z, increasingly prefer credit for flexibility but are also more debt-averse compared to previous generations, shaped by economic crises and changing values.

Conclusion: The Path Forward

At its core, shaping financial unification strategies demands a nuanced appreciation of cultural borrowing habits. Policymakers, financial institutions, and communities must recognize these diverse attitudes as assets, not obstacles. Only then can we build resilient, inclusive financial systems that honor tradition while embracing innovation.